Vectra offers an AI-powered cyber-threat detection platform, which automates threat detection, reveals hidden attackers specifically targeting financial institutions, accelerates investigations after incidents and even identifies compromised information. Here are a few examples of companies providing AI-based cybersecurity solutions for major financial institutions. Every day, huge quantities of digital transactions take place as users move money, pay bills, deposit checks and trade stocks online. The need to ramp up cybersecurity and fraud detection efforts is now a necessity for any bank or financial institution, and AI plays a key role in improving the security of online finance. Here are a few examples of companies using AI to learn from customers and create a better banking experience. The platform lets investors buy, sell and operate single-family homes through its SaaS and expert services.

Market Updates

As a regulatory compliant platform, the foundation enables developers from these competing organizations to collaborate on projects with a strong propensity for mutualization. It has enabled codebase contributions from both the buy- and sell-side firms and counts over 50 major financial institutions, fintechs and technology consultancies as part of its membership. FINOS is also part of the https://www.online-accounting.net/ Linux Foundation, the largest shared technology organization in the world. The integration of LLMs into the financial sector offers promising opportunities to enhance efficiency, reduce costs and improve customer experiences. By implementing a human-in-the-loop system, financial institutions can leverage the power of AI while helping ensure compliance, ethical standards and accountability.

How DZ BANK improved developer productivity with Cloud Workstations

A financial institution can draw insights from the details explored in this article, decide how much to centralize the various components of its gen AI operating model, and tailor its approach to its own structure and culture. An organization, for instance, could use a centralized approach for risk, https://www.quickbooks-payroll.org/the-5-best-expense-tracker-apps-of-2023/ technology architecture, and partnership choices, while going with a more federated design for strategic decision making and execution. With machine learning technologies, computers can be taught to analyze data, identify hidden patterns, make classifications, and predict future outcomes.

AI in Personal Finance

Indeed, in addition to more qualitative goals, AI solutions are often meant to automate labor-intensive tasks and help improve productivity. Thus, cost saving is definitely a core opportunity for companies setting expectations and measuring results for AI initiatives. From the survey, we found three distinctive traits that appear to separate frontrunners from the rest.

A good user experience can get executives to take action by integrating the often irrational aspect of human behavior into the design element. While these skills are often necessary in the initial stages of the AI journey, starters and followers should take note of the skill shortages identified by frontrunners, which could help them prepare for expanding their own initiatives. Frontrunners surveyed highlighted a shortage of specialized skill sets required for building and rolling out AI implementations—namely, software developers and user experience designers (figure 13). From our survey, it was no surprise to see that most respondents, across all segments, acquired AI through enterprise software that embedded intelligent capabilities (figure 9). With existing vendor relationships and technology platforms already in use, this is likely the easiest option for most companies to choose. Financial services are entering the artificial intelligence arena and are at varying stages of incorporating it into their long-term organizational strategies.

Rob specializes in helping insurers redesign core operations and serves as a lead consulting partner for two commercial P&C insurers. Rob is passionate about building our communities of practice, leading the Chicago Educational Co-op and FSI Community, and having recently served as the Chicago S&O Local Service Area Champion. It is important, however, to realize that we are still in the early stages of AI transformation of financial services, and therefore, organizations would likely benefit by taking a long-term view. « Financial services institutions are facing immense computational demands and the pressing need for modernization, » said Adam Honoré, Head of Financial Services Service Development, at AWS. The audit solution provided by Trullion allows the execution of audits for multiple clients using automated and intelligent workflows.

Too often, banking leaders call for new operating models to support new technologies. Successful institutions’ models already enable flexibility and scalability to support new capabilities. An operating model that is fit for scale-up is cross-functional and aligns accountabilities and responsibilities between delivery and business teams.

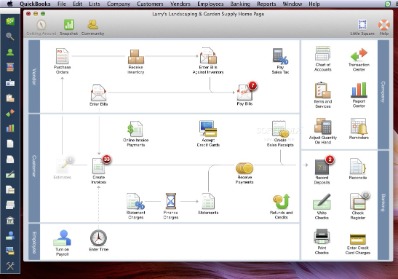

Domo’s platform enables finance professionals to access information to support financial planning, budgeting, forecasting, and reporting. Our evaluation found that you can connect Domo with 203 finance apps, including NetSuite, QuickBooks, Sage Intacct, Xero, and FreshBooks. Zoho Finance Plus combines the functionalities of various Zoho products such as Zoho Invoice, Zoho Books, Zoho Checkout, Zoho Expense, Zoho Inventory, and Zoho Billing into a single platform. This integrated solution is tightly connected with Zoho CRM, providing a unified experience for managing contact interactions, sales and purchase orders, inventory management, expenses, subscriptions, accounting, online payments, and tax compliance.

- These are mainly large institutions whose business units can muster sufficient resources for an autonomous gen AI approach.

- In October 2023, the company launched its generative AI tool, NetSuite Text Enhance, which helps users create and refine personalized and contextual content using AI technology.

- A financial institution can draw insights from the details explored in this article, decide how much to centralize the various components of its gen AI operating model, and tailor its approach to its own structure and culture.

- The pressing questions for banking institutions are how and where to use gen AI most effectively, and how to ensure the applications are fully adopted and scaled within their organizations.

Regulations such as the General Data Protection Regulation (GDPR) in Europe, the Dodd-Frank Act in the United States and various anti-money laundering (AML) laws worldwide impose strict compliance requirements on financial entities. These regulations help ensure that customer data is handled securely, financial advice is given responsibly and transactions are monitored for fraudulent activity. Through its ability to predict, adapt and learn, AI presents a compelling new solution to address today’s business challenges and enable tomorrow’s business models, empowering business decisions and uncovering opportunities. It also allows organizations to power their human enterprise by unlocking the core strengths of ingenuity, adaptability, empathy and trust using technology at speed and innovation at scale. This EY-supported research provides an important reference for leaders in all sectors to better understand current areas of focus, attitudes toward AI and future considerations that need to be addressed. FinTechs are more likely than incumbents to create AI-based products and services, rather than mostly using the technology to improve existing products.

By incorporating copilots into their workflow, wealth managers can significantly enhance their productivity and deliver more valuable insights. These copilots use fine-tuned base models with even greater access to proprietary data than customer-facing chatbots since copilots are meant for authorized employees. This means the copilots are even more powerful, providing a productivity boost for wealth managers while increasing customer satisfaction as investors get personalized advice more quickly. Automation using AI is essential for the financial services industry to meet customer demands for better personalization and enhanced features while reducing costs.

Financial institutions are increasingly using AI for exposure modeling in finance to assess and manage various types of risks that financial institutions face. Exposure modeling involves estimating the potential losses a firm may experience under different market conditions, such as changes in interest rates, credit defaults, or market volatility. Optimizing strategies using instruments topic no 704 depreciation like equity derivatives and interest-rate swaps may allow institutions to optimize portfolios and offer better prices to customers. The dynamic landscape of gen AI in banking demands a strategic approach to operating models. Banks and other financial institutions should balance speed and innovation with risk, adapting their structures to harness the technology’s full potential.

Earlier in her career, she worked as a consultant advising technology firms on market entry and international expansion. Insider Intelligence estimates both online and mobile banking adoption among US consumers will rise by 2024, reaching 72.8% and 58.1%, respectively—making AI implementation critical for FIs looking to be successful and competitive in the evolving industry. Naturally, banks encounter distinct regulatory oversight, concerning issues such as model interpretability and unbiased decision making, that must be comprehensively tackled before scaling any application. In capital markets, gen AI tools can serve as research assistants for investment analysts.

10 Best AI Tools for Accounting & Finance in 2024

Vectra offers an AI-powered cyber-threat detection platform, which automates threat detection, reveals hidden attackers specifically targeting financial institutions, accelerates investigations after incidents and even identifies compromised information. Here are a few examples of companies providing AI-based cybersecurity solutions for major financial institutions. Every day, huge quantities of digital transactions take place as users move money, pay bills, deposit checks and trade stocks online. The need to ramp up cybersecurity and fraud detection efforts is now a necessity for any bank or financial institution, and AI plays a key role in improving the security of online finance. Here are a few examples of companies using AI to learn from customers and create a better banking experience. The platform lets investors buy, sell and operate single-family homes through its SaaS and expert services.

Market Updates

As a regulatory compliant platform, the foundation enables developers from these competing organizations to collaborate on projects with a strong propensity for mutualization. It has enabled codebase contributions from both the buy- and sell-side firms and counts over 50 major financial institutions, fintechs and technology consultancies as part of its membership. FINOS is also part of the https://www.online-accounting.net/ Linux Foundation, the largest shared technology organization in the world. The integration of LLMs into the financial sector offers promising opportunities to enhance efficiency, reduce costs and improve customer experiences. By implementing a human-in-the-loop system, financial institutions can leverage the power of AI while helping ensure compliance, ethical standards and accountability.

How DZ BANK improved developer productivity with Cloud Workstations

A financial institution can draw insights from the details explored in this article, decide how much to centralize the various components of its gen AI operating model, and tailor its approach to its own structure and culture. An organization, for instance, could use a centralized approach for risk, https://www.quickbooks-payroll.org/the-5-best-expense-tracker-apps-of-2023/ technology architecture, and partnership choices, while going with a more federated design for strategic decision making and execution. With machine learning technologies, computers can be taught to analyze data, identify hidden patterns, make classifications, and predict future outcomes.

AI in Personal Finance

Indeed, in addition to more qualitative goals, AI solutions are often meant to automate labor-intensive tasks and help improve productivity. Thus, cost saving is definitely a core opportunity for companies setting expectations and measuring results for AI initiatives. From the survey, we found three distinctive traits that appear to separate frontrunners from the rest.

A good user experience can get executives to take action by integrating the often irrational aspect of human behavior into the design element. While these skills are often necessary in the initial stages of the AI journey, starters and followers should take note of the skill shortages identified by frontrunners, which could help them prepare for expanding their own initiatives. Frontrunners surveyed highlighted a shortage of specialized skill sets required for building and rolling out AI implementations—namely, software developers and user experience designers (figure 13). From our survey, it was no surprise to see that most respondents, across all segments, acquired AI through enterprise software that embedded intelligent capabilities (figure 9). With existing vendor relationships and technology platforms already in use, this is likely the easiest option for most companies to choose. Financial services are entering the artificial intelligence arena and are at varying stages of incorporating it into their long-term organizational strategies.

Rob specializes in helping insurers redesign core operations and serves as a lead consulting partner for two commercial P&C insurers. Rob is passionate about building our communities of practice, leading the Chicago Educational Co-op and FSI Community, and having recently served as the Chicago S&O Local Service Area Champion. It is important, however, to realize that we are still in the early stages of AI transformation of financial services, and therefore, organizations would likely benefit by taking a long-term view. « Financial services institutions are facing immense computational demands and the pressing need for modernization, » said Adam Honoré, Head of Financial Services Service Development, at AWS. The audit solution provided by Trullion allows the execution of audits for multiple clients using automated and intelligent workflows.

Too often, banking leaders call for new operating models to support new technologies. Successful institutions’ models already enable flexibility and scalability to support new capabilities. An operating model that is fit for scale-up is cross-functional and aligns accountabilities and responsibilities between delivery and business teams.

Domo’s platform enables finance professionals to access information to support financial planning, budgeting, forecasting, and reporting. Our evaluation found that you can connect Domo with 203 finance apps, including NetSuite, QuickBooks, Sage Intacct, Xero, and FreshBooks. Zoho Finance Plus combines the functionalities of various Zoho products such as Zoho Invoice, Zoho Books, Zoho Checkout, Zoho Expense, Zoho Inventory, and Zoho Billing into a single platform. This integrated solution is tightly connected with Zoho CRM, providing a unified experience for managing contact interactions, sales and purchase orders, inventory management, expenses, subscriptions, accounting, online payments, and tax compliance.

Regulations such as the General Data Protection Regulation (GDPR) in Europe, the Dodd-Frank Act in the United States and various anti-money laundering (AML) laws worldwide impose strict compliance requirements on financial entities. These regulations help ensure that customer data is handled securely, financial advice is given responsibly and transactions are monitored for fraudulent activity. Through its ability to predict, adapt and learn, AI presents a compelling new solution to address today’s business challenges and enable tomorrow’s business models, empowering business decisions and uncovering opportunities. It also allows organizations to power their human enterprise by unlocking the core strengths of ingenuity, adaptability, empathy and trust using technology at speed and innovation at scale. This EY-supported research provides an important reference for leaders in all sectors to better understand current areas of focus, attitudes toward AI and future considerations that need to be addressed. FinTechs are more likely than incumbents to create AI-based products and services, rather than mostly using the technology to improve existing products.

By incorporating copilots into their workflow, wealth managers can significantly enhance their productivity and deliver more valuable insights. These copilots use fine-tuned base models with even greater access to proprietary data than customer-facing chatbots since copilots are meant for authorized employees. This means the copilots are even more powerful, providing a productivity boost for wealth managers while increasing customer satisfaction as investors get personalized advice more quickly. Automation using AI is essential for the financial services industry to meet customer demands for better personalization and enhanced features while reducing costs.

Financial institutions are increasingly using AI for exposure modeling in finance to assess and manage various types of risks that financial institutions face. Exposure modeling involves estimating the potential losses a firm may experience under different market conditions, such as changes in interest rates, credit defaults, or market volatility. Optimizing strategies using instruments topic no 704 depreciation like equity derivatives and interest-rate swaps may allow institutions to optimize portfolios and offer better prices to customers. The dynamic landscape of gen AI in banking demands a strategic approach to operating models. Banks and other financial institutions should balance speed and innovation with risk, adapting their structures to harness the technology’s full potential.

Earlier in her career, she worked as a consultant advising technology firms on market entry and international expansion. Insider Intelligence estimates both online and mobile banking adoption among US consumers will rise by 2024, reaching 72.8% and 58.1%, respectively—making AI implementation critical for FIs looking to be successful and competitive in the evolving industry. Naturally, banks encounter distinct regulatory oversight, concerning issues such as model interpretability and unbiased decision making, that must be comprehensively tackled before scaling any application. In capital markets, gen AI tools can serve as research assistants for investment analysts.

Les plus lus

AAFX Trading Review 2024 Information about AAFX Trading Forex Broker

AAFX Trading Forex Brokers Reviews

Почему альпари

Bond finance Wikipedia

10 Best AI Tools for Accounting & Finance in 2024

Tags